After a decade of generational upgrades, 5G has driven a substantial dual growth in both demand for PCB (Printed Circuit Board) and copper-clad materials, as well as in their value-added applications. China’s IMT-2020 (5G) Promotion Group identified the “five key technologies” essential to 5G’s advancement. This has significantly altered the landscape of the wireless access network equipment industry chain.

### 1) The Introduction of Massive MIMO in 5G RF

One of the most significant developments in 5G is the adoption of Massive MIMO (Multiple Input, Multiple Output) technology. In comparison to 4G, 5G base stations are expected to increase dramatically in number. We project that two-thirds of the output of mobile base station antennas will shift to the PCB industry chain. As a result, the value of high-frequency PCBs and copper-clad materials for 5G base station antennas will grow by more than ten times compared to 4G. This leap highlights the increasing importance of high-performance materials to support the advanced capabilities of 5G technology.

### 2) The Surge in Broadband Traffic and High-Speed Equipment Demand

The 5G network is designed to handle a significantly higher volume of broadband traffic. As a result, there will be increased investments in infrastructure such as routers, switches, and data centers (IDCs). Consequently, the demand for high-speed PCB and copper-clad materials will see a marked rise. Beyond the sheer volume increase, high-performance equipment will require specialized, value-added components, such as high-frequency (for antennas) and high-speed (for IDCs and base stations) PCBs. This shift will lead to enhanced consumption and greater value creation within the PCB and copper-clad material supply chain.

In summary, the roll-out of 5G is not only expanding the overall demand for PCB and copper-clad materials but also driving the need for more advanced, high-value products to support the sophisticated infrastructure required by the next-generation wireless network.

The PCB (Printed Circuit Board) industry is poised for significant transformation in the next three years, driven primarily by the rise of 5G communication equipment. As the industry has matured, the traditional application markets are now saturated, and future growth hinges on the development of emerging downstream sectors. According to Prismark, the automotive and communication equipment sectors are expected to become the new engines of growth over the next five years. Both automotive electronics (which are closely tied to daily life) and communication devices (which have high individual unit values and wide application scope) will influence the certification of upstream materials in their respective industries.

In recent years, the automotive market—especially in the realms of smart driving and new energy vehicles—has experienced rapid development. However, the certification process for automotive boards remains challenging, particularly for high-value core components like ADAS (Advanced Driver Assistance Systems) and energy management systems. These components are currently difficult for Chinese manufacturers to produce, although there have been notable breakthroughs in a relatively short period. On the other hand, China’s communication equipment manufacturers have made a successful transition from being followers to leaders in the 5G era. This shift is expected to drive demand for high-end, high-frequency, and high-speed PCBs. As such, we anticipate that the PCB industry will be a central driver of growth over the next three years.

The shift to 5G also brings significant opportunities for the localization of high-end materials, moving from mere recycling to actual growth in production capabilities. Copper clad laminates (CCL) are the primary material used in PCB manufacturing. These products can be divided into traditional and high-end variants. Traditional copper clad laminates primarily include epoxy fiberglass boards (such as FR-4 and modified FR-4) and simple composite materials (such as CEM-1 and CEM-3). Currently, production capacity for these materials has largely moved from Europe, the U.S., and Japan to mainland China, which now accounts for 65% of the global output value of copper clad laminates.

However, high-end copper clad laminates—particularly those made from specialized materials—are still dominated by foreign firms like Rogers, Taconic, and Panasonic. These special materials, which are composed of unique resin fillers, include PTFE (used in millimeter-wave radar and ultra-high-frequency communications), hydrocarbon (for 6GHz base station radio frequency), and PPE/CE (for high-speed multilayer PCBs). Such materials offer higher added value and unit prices compared to traditional FR-4 products, which makes them less susceptible to the cyclical fluctuations in raw material prices. As demand for 5G and automotive electronics continues to rise, high-end manufacturers are positioned to capitalize on the growth of these emerging sectors. In the 5G era, domestic producers with advanced manufacturing capabilities are expected to challenge foreign monopolies, reduce the industry’s reliance on cyclical patterns, and experience simultaneous improvements in both performance and valuation.

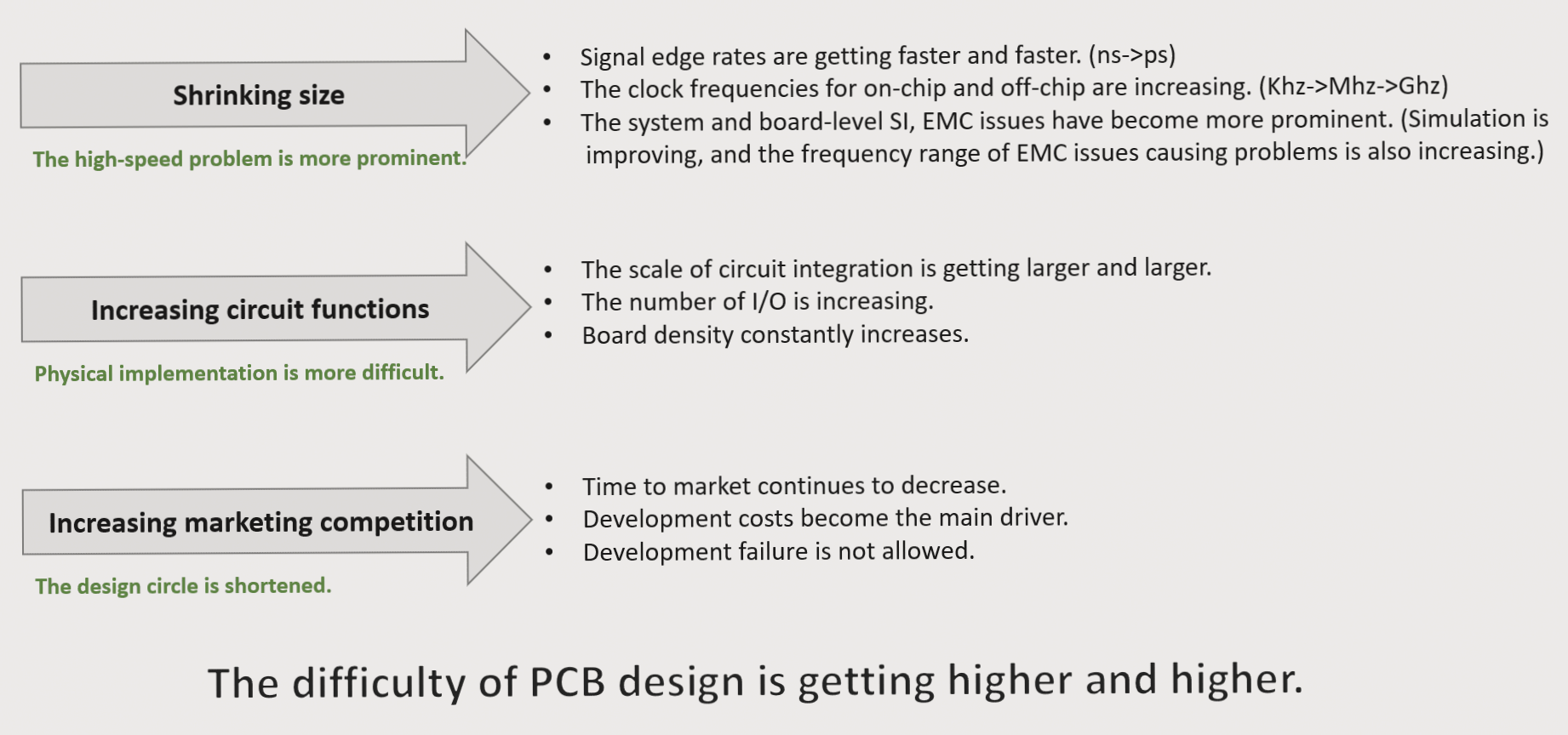

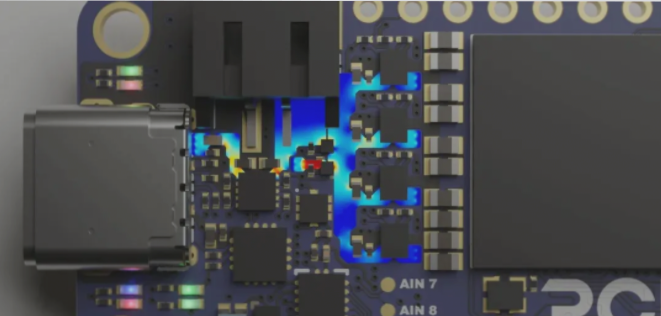

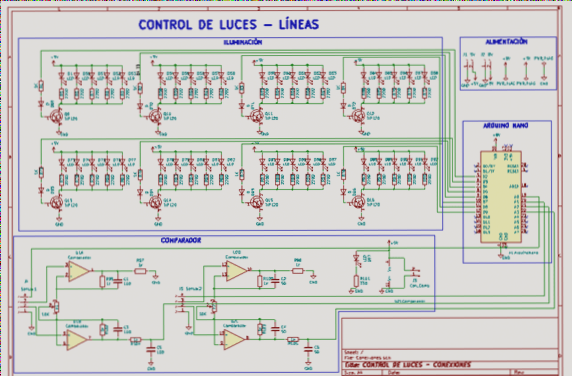

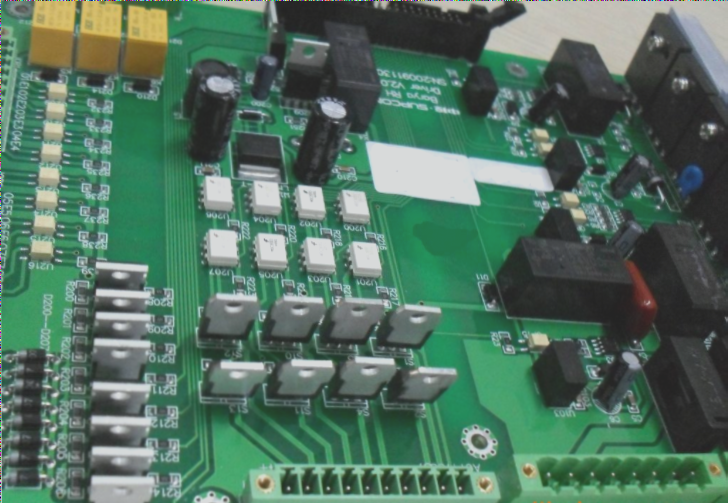

The role of 5G equipment PCBs will be determined by a combination of “process” and “material” factors. While high-end materials are crucial, the PCB manufacturing process and design also have a significant impact on the final performance of the product. “Process + Material” will play a key role in sharing the added value created by 5G within the industry. For 5G, PCBs need to meet rigorous standards in terms of high-frequency and high-speed performance, which requires precise impedance control during the design phase. Additionally, 5G equipment PCBs must be capable of handling complex specifications, such as multi-layer construction, large areas with small thickness-to-diameter ratios, fine drilling accuracy (small hole sizes and proper board alignment), and intricate wiring with precise line width and spacing. These demanding requirements necessitate closer technical collaboration throughout the PCB processing and production phases.

In conclusion, the next three years will be crucial for the PCB industry, with 5G communications leading the charge. The transition to higher-end materials and more advanced manufacturing processes, coupled with breakthroughs in domestic production capabilities, will determine the pace of growth and market leadership in this evolving sector.

### 1) The Introduction of Massive MIMO in 5G RF

One of the most significant developments in 5G is the adoption of Massive MIMO (Multiple Input, Multiple Output) technology. In comparison to 4G, 5G base stations are expected to increase dramatically in number. We project that two-thirds of the output of mobile base station antennas will shift to the PCB industry chain. As a result, the value of high-frequency PCBs and copper-clad materials for 5G base station antennas will grow by more than ten times compared to 4G. This leap highlights the increasing importance of high-performance materials to support the advanced capabilities of 5G technology.

### 2) The Surge in Broadband Traffic and High-Speed Equipment Demand

The 5G network is designed to handle a significantly higher volume of broadband traffic. As a result, there will be increased investments in infrastructure such as routers, switches, and data centers (IDCs). Consequently, the demand for high-speed PCB and copper-clad materials will see a marked rise. Beyond the sheer volume increase, high-performance equipment will require specialized, value-added components, such as high-frequency (for antennas) and high-speed (for IDCs and base stations) PCBs. This shift will lead to enhanced consumption and greater value creation within the PCB and copper-clad material supply chain.

In summary, the roll-out of 5G is not only expanding the overall demand for PCB and copper-clad materials but also driving the need for more advanced, high-value products to support the sophisticated infrastructure required by the next-generation wireless network.

The PCB (Printed Circuit Board) industry is poised for significant transformation in the next three years, driven primarily by the rise of 5G communication equipment. As the industry has matured, the traditional application markets are now saturated, and future growth hinges on the development of emerging downstream sectors. According to Prismark, the automotive and communication equipment sectors are expected to become the new engines of growth over the next five years. Both automotive electronics (which are closely tied to daily life) and communication devices (which have high individual unit values and wide application scope) will influence the certification of upstream materials in their respective industries.

In recent years, the automotive market—especially in the realms of smart driving and new energy vehicles—has experienced rapid development. However, the certification process for automotive boards remains challenging, particularly for high-value core components like ADAS (Advanced Driver Assistance Systems) and energy management systems. These components are currently difficult for Chinese manufacturers to produce, although there have been notable breakthroughs in a relatively short period. On the other hand, China’s communication equipment manufacturers have made a successful transition from being followers to leaders in the 5G era. This shift is expected to drive demand for high-end, high-frequency, and high-speed PCBs. As such, we anticipate that the PCB industry will be a central driver of growth over the next three years.

The shift to 5G also brings significant opportunities for the localization of high-end materials, moving from mere recycling to actual growth in production capabilities. Copper clad laminates (CCL) are the primary material used in PCB manufacturing. These products can be divided into traditional and high-end variants. Traditional copper clad laminates primarily include epoxy fiberglass boards (such as FR-4 and modified FR-4) and simple composite materials (such as CEM-1 and CEM-3). Currently, production capacity for these materials has largely moved from Europe, the U.S., and Japan to mainland China, which now accounts for 65% of the global output value of copper clad laminates.

However, high-end copper clad laminates—particularly those made from specialized materials—are still dominated by foreign firms like Rogers, Taconic, and Panasonic. These special materials, which are composed of unique resin fillers, include PTFE (used in millimeter-wave radar and ultra-high-frequency communications), hydrocarbon (for 6GHz base station radio frequency), and PPE/CE (for high-speed multilayer PCBs). Such materials offer higher added value and unit prices compared to traditional FR-4 products, which makes them less susceptible to the cyclical fluctuations in raw material prices. As demand for 5G and automotive electronics continues to rise, high-end manufacturers are positioned to capitalize on the growth of these emerging sectors. In the 5G era, domestic producers with advanced manufacturing capabilities are expected to challenge foreign monopolies, reduce the industry’s reliance on cyclical patterns, and experience simultaneous improvements in both performance and valuation.

The role of 5G equipment PCBs will be determined by a combination of “process” and “material” factors. While high-end materials are crucial, the PCB manufacturing process and design also have a significant impact on the final performance of the product. “Process + Material” will play a key role in sharing the added value created by 5G within the industry. For 5G, PCBs need to meet rigorous standards in terms of high-frequency and high-speed performance, which requires precise impedance control during the design phase. Additionally, 5G equipment PCBs must be capable of handling complex specifications, such as multi-layer construction, large areas with small thickness-to-diameter ratios, fine drilling accuracy (small hole sizes and proper board alignment), and intricate wiring with precise line width and spacing. These demanding requirements necessitate closer technical collaboration throughout the PCB processing and production phases.

In conclusion, the next three years will be crucial for the PCB industry, with 5G communications leading the charge. The transition to higher-end materials and more advanced manufacturing processes, coupled with breakthroughs in domestic production capabilities, will determine the pace of growth and market leadership in this evolving sector.