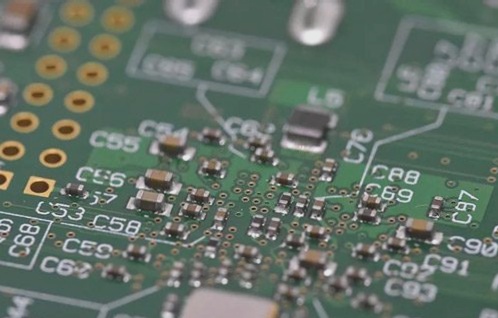

Automotive PCB electronics constitute the third largest application category of PCB circuit boards, following computers and communications. As automobiles evolve from traditional mechanical commodities to sophisticated, intelligent, and interconnected high-tech products, electronic technology has become ubiquitous within the automotive sector. Whether for the starter, chassis, safety, information, or internal environment systems, electronic components are universally integrated. Consequently, the automotive market stands out as a significant segment in the consumer electronics sector. The advancement of automotive electronics inherently propels the growth of automotive PCB technology.

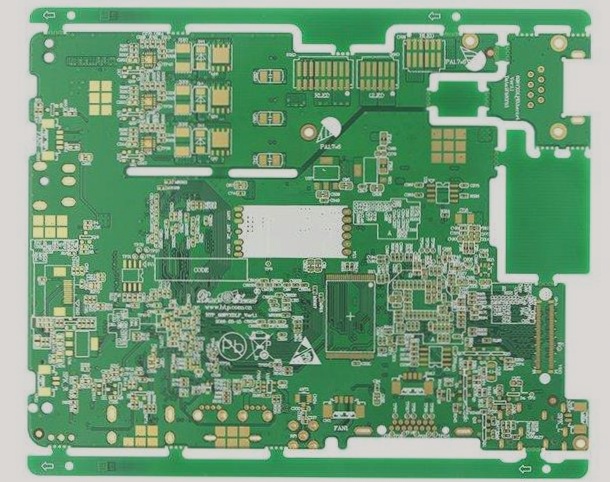

In today’s landscape of printed circuit boards, automotive PCBs hold a pivotal position. However, owing to the unique operational environment and stringent safety and high current demands of automotive applications, there exist elevated standards for PCB reliability and environmental compliance. This necessitates a wide array of PCB technology capabilities, posing a formidable challenge for PCB enterprises. Companies aspiring to penetrate the automotive PCB market must thoroughly comprehend and analyze this evolving sector.

Automotive PCBs emphasize high reliability and low Defective Parts Per Million (DPPM). Does our enterprise possess the technological expertise and experience in high-reliability manufacturing? Are we prepared to chart a course distinct from future commodity development trends? Can we effectively implement process controls aligned with TS16949 requirements and achieve low DPPM rates? These critical questions require careful consideration. Rushing into this enticing market without due diligence risks undermining the PCB enterprise itself.

Although PCBs are often associated with consumer electronics and 5G, the growing prominence of new energy vehicles has also brought automotive electronics to the forefront. In the automotive industry, PCBs are integral to auxiliary driving, on-board communication, electric control, and other essential functions. While traditional fuel vehicles typically use about 1 square meter of PCBs on average, high-end models may require 2-3 square meters per vehicle, with the PCB value averaging around 500-600 CNY per vehicle.

In contrast, the integration of Battery Management Systems (BMS), Microcontroller Units (MCUs), and other advanced technologies in new energy vehicles has substantially increased the PCB area to 3-5 square meters per vehicle. Consequently, the per-vehicle PCB value now exceeds 2000 CNY, nearly four times that of traditional fuel vehicles. According to Prismark data, the global automotive PCB market had an output value of US $6.19 billion last year, with expectations to reach US $8.75 billion by 2024, constituting 10.6% of the global PCB output value. The projected compound annual growth rate from 2020 to 2024 stands at 9%.

Moreover, there is burgeoning interest in the FPC (Flexible Printed Circuit) segment. In traditional fuel vehicles, each vehicle typically integrates over 100 FPCs, primarily supporting onboard displays, vehicle electronic systems, engine controls, seating, doors, vehicle management, and safety systems such as image processing and sensors.

1. Secondary Testing Method

Local consumer automotive PCB enterprises employ the “secondary testing method” to reduce the rate of defective boards post initial high-voltage breakdown.

2. Anti-Mistake Test for Broken Boards

An increasing number of PCB manufacturers have integrated a “good board marking system” and a “bad board error-proofing box” into their light board testing machines. This setup effectively prevents human-induced errors. The good board marking system prevents the testing machine from marking boards that have passed, thereby ensuring that tested or faulty boards do not reach customers. The bad board error-proofing box signals the partial input box to open during testing of a pass board, and conversely, it closes when a faulty board is tested, guiding operators to correctly handle the tested circuit board.

3. Implementation of PPM Quality System

Currently, a PPM (parts per million) quality system is widely adopted among PCB manufacturers. Notably, Hitachi Chemical in Singapore has pioneered its effective application. Over 20 personnel at their facility are dedicated to statistically analyzing online PCB quality issues and the return of defective PCBs. Statistical Process Control (SPC) is employed to classify and analyze each faulty and returned board. Micro-slicing and other tools are used to pinpoint manufacturing process issues contributing to board defects. Based on statistical insights, corrective actions are purposefully implemented throughout the production process.

4. Comparative Testing Approach

Certain customers conduct comparative testing using PCB boards from different batches and brands to monitor corresponding PPM rates. This approach aids in optimizing testing machine selection for automotive PCB boards.

5. Advancement in Test Parameters

Adopting higher test parameters enhances the detection capability for such PCB boards. For instance, a major Taiwanese-funded PCB enterprise in Suzhou utilizes 300V, 30m, and 20 Ω parameters for testing automotive PCBs, thereby improving detection rates of defective boards.

6. Calibration of Current Test Equipment Parameters

Following operational use, internal resistance and other relevant test parameters of testers may drift. Hence, regular calibration of machine parameters is essential to ensure testing accuracy. Many large printed circuit board enterprises maintain a practice of biannual or annual adjustments to equipment parameters. Achieving “zero-defect” multi-layer automotive PCBs remains a continuous goal, albeit challenges persist in process equipment and raw materials. WellCircuits continues to explore strategies for reducing PPM over time.

In today’s landscape of printed circuit boards, automotive PCBs hold a pivotal position. However, owing to the unique operational environment and stringent safety and high current demands of automotive applications, there exist elevated standards for PCB reliability and environmental compliance. This necessitates a wide array of PCB technology capabilities, posing a formidable challenge for PCB enterprises. Companies aspiring to penetrate the automotive PCB market must thoroughly comprehend and analyze this evolving sector.

Automotive PCBs emphasize high reliability and low Defective Parts Per Million (DPPM). Does our enterprise possess the technological expertise and experience in high-reliability manufacturing? Are we prepared to chart a course distinct from future commodity development trends? Can we effectively implement process controls aligned with TS16949 requirements and achieve low DPPM rates? These critical questions require careful consideration. Rushing into this enticing market without due diligence risks undermining the PCB enterprise itself.

Although PCBs are often associated with consumer electronics and 5G, the growing prominence of new energy vehicles has also brought automotive electronics to the forefront. In the automotive industry, PCBs are integral to auxiliary driving, on-board communication, electric control, and other essential functions. While traditional fuel vehicles typically use about 1 square meter of PCBs on average, high-end models may require 2-3 square meters per vehicle, with the PCB value averaging around 500-600 CNY per vehicle.

In contrast, the integration of Battery Management Systems (BMS), Microcontroller Units (MCUs), and other advanced technologies in new energy vehicles has substantially increased the PCB area to 3-5 square meters per vehicle. Consequently, the per-vehicle PCB value now exceeds 2000 CNY, nearly four times that of traditional fuel vehicles. According to Prismark data, the global automotive PCB market had an output value of US $6.19 billion last year, with expectations to reach US $8.75 billion by 2024, constituting 10.6% of the global PCB output value. The projected compound annual growth rate from 2020 to 2024 stands at 9%.

Moreover, there is burgeoning interest in the FPC (Flexible Printed Circuit) segment. In traditional fuel vehicles, each vehicle typically integrates over 100 FPCs, primarily supporting onboard displays, vehicle electronic systems, engine controls, seating, doors, vehicle management, and safety systems such as image processing and sensors.

1. Secondary Testing Method

Local consumer automotive PCB enterprises employ the “secondary testing method” to reduce the rate of defective boards post initial high-voltage breakdown.

2. Anti-Mistake Test for Broken Boards

An increasing number of PCB manufacturers have integrated a “good board marking system” and a “bad board error-proofing box” into their light board testing machines. This setup effectively prevents human-induced errors. The good board marking system prevents the testing machine from marking boards that have passed, thereby ensuring that tested or faulty boards do not reach customers. The bad board error-proofing box signals the partial input box to open during testing of a pass board, and conversely, it closes when a faulty board is tested, guiding operators to correctly handle the tested circuit board.

3. Implementation of PPM Quality System

Currently, a PPM (parts per million) quality system is widely adopted among PCB manufacturers. Notably, Hitachi Chemical in Singapore has pioneered its effective application. Over 20 personnel at their facility are dedicated to statistically analyzing online PCB quality issues and the return of defective PCBs. Statistical Process Control (SPC) is employed to classify and analyze each faulty and returned board. Micro-slicing and other tools are used to pinpoint manufacturing process issues contributing to board defects. Based on statistical insights, corrective actions are purposefully implemented throughout the production process.

4. Comparative Testing Approach

Certain customers conduct comparative testing using PCB boards from different batches and brands to monitor corresponding PPM rates. This approach aids in optimizing testing machine selection for automotive PCB boards.

5. Advancement in Test Parameters

Adopting higher test parameters enhances the detection capability for such PCB boards. For instance, a major Taiwanese-funded PCB enterprise in Suzhou utilizes 300V, 30m, and 20 Ω parameters for testing automotive PCBs, thereby improving detection rates of defective boards.

6. Calibration of Current Test Equipment Parameters

Following operational use, internal resistance and other relevant test parameters of testers may drift. Hence, regular calibration of machine parameters is essential to ensure testing accuracy. Many large printed circuit board enterprises maintain a practice of biannual or annual adjustments to equipment parameters. Achieving “zero-defect” multi-layer automotive PCBs remains a continuous goal, albeit challenges persist in process equipment and raw materials. WellCircuits continues to explore strategies for reducing PPM over time.