The Importance of Cost Accounting in Modern PCB Companies

Accurate cost accounting is essential for guiding business operations and enhancing competitiveness in the PCB industry.

Cost accounting in PCB companies influences decision-making, pricing strategies, internal controls, and compliance with tax regulations. It presents unique challenges due to high order volumes, quality requirements, and short delivery times.

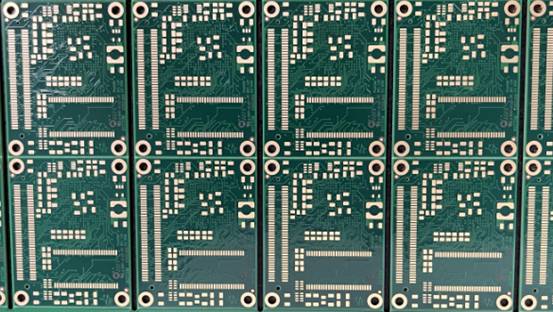

The Key Steps in PCB Enterprise Cost Accounting

- Calculate production costs and determine total product cost and unit cost.

- Audit production costs for compliance and define cost calculation objects.

- Summarize expenses, allocate costs, and distribute them for accurate accounting.

Components of Product Costs

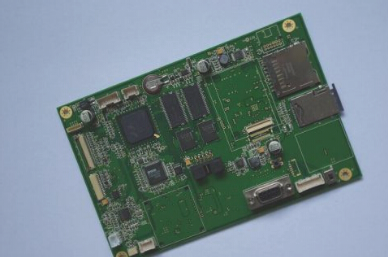

Product costs in PCB companies consist of direct materials, direct labor, and manufacturing overhead.

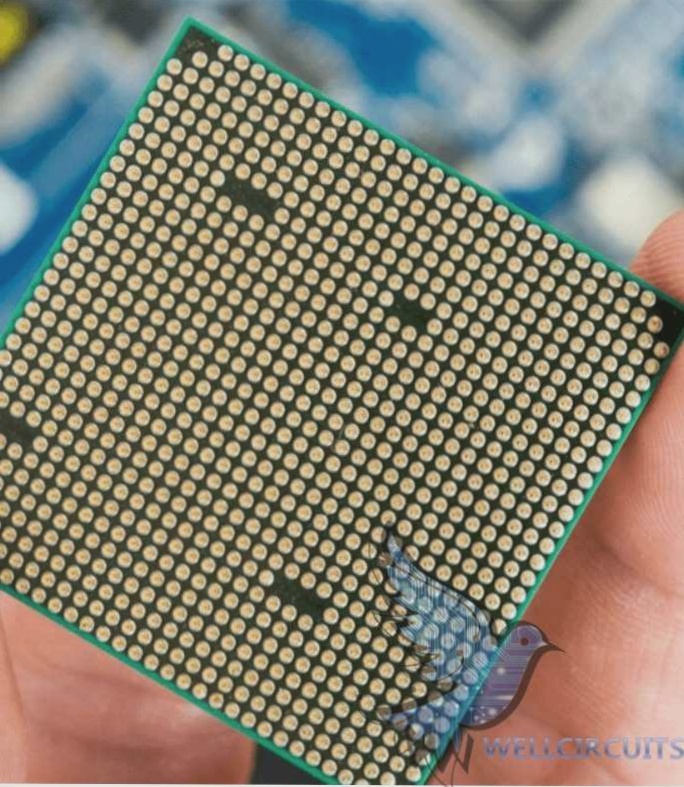

Direct Material Cost

In the PCB industry, materials are allocated based on output statistics and material sharing methods. Primary materials like copper plates, foils, inks, and dry films are crucial for production. Companies use concepts like thousand-foot consumption to calculate material quotas and costs accurately.

Direct Labor Costs

PCB companies manage labor costs through hourly wages or piece rates. Tracking working hours, output statistics, and bonuses helps determine the standard labor rate for cost accounting.

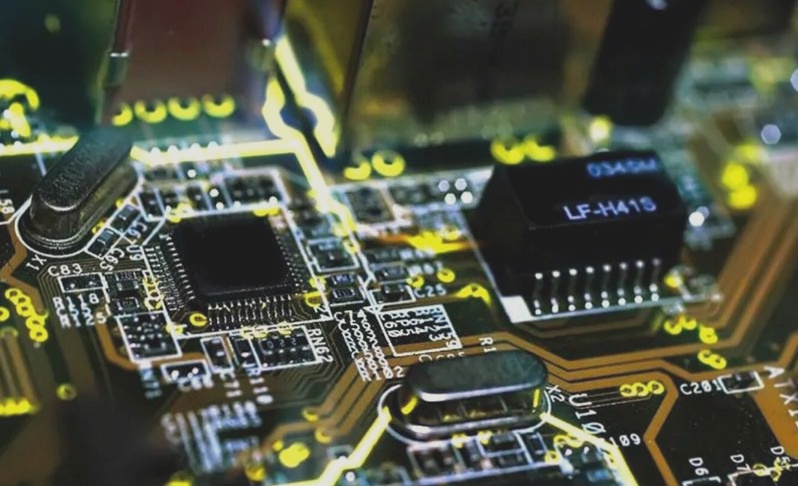

Manufacturing Costs in PCB Production

Manufacturing costs in PCB production involve utilities, repairs, and asset depreciation. Allocating these costs accurately to each product is a challenging task.

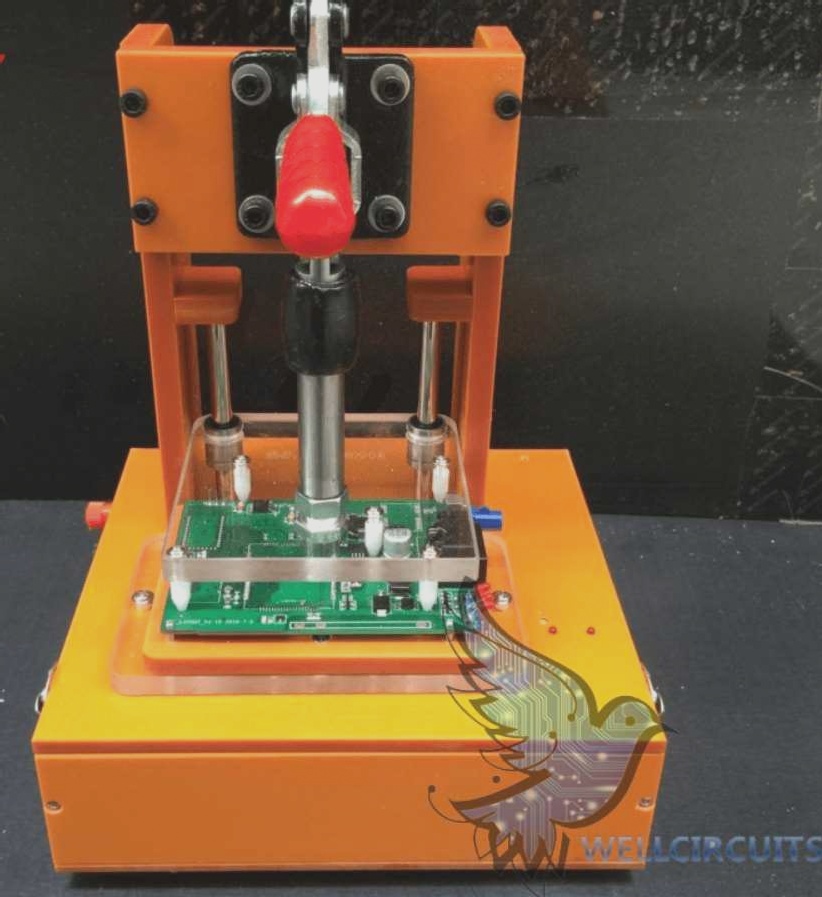

3.1 Drilling Costs for PCB Manufacturing

When it comes to PCB drilling, the costs are directly impacted by factors such as the number and size of holes, as well as the thickness-to-hole ratio. Many PCB companies now use the “aperture single hole cost” concept to manage these expenses effectively.

3.2 Surface Treatment Costs in Manufacturing

Surface treatment processes like lead-tin spraying, OSP coating, and tin, silver, or gold application play a crucial role in determining product costs. Managing cost discrepancies can be achieved by allocating expenses based on the specific treatment processes involved.

3.3 Gold Salt Usage and Manufacturing Expenses

Effective management of gold salt usage is vital for PCB manufacturers. Calculating the amount of gold salt needed based on plating thickness and area, and multiplying it by the unit price, helps determine the overall cost accurately.

Summary: Efficient Cost Management for PCB Products

PCB products pose unique challenges for cost accounting. To streamline cost management, companies are advised to harness advanced information technology. Developing a tailored calculation model within their systems enables swift and precise cost calculations for PCB products and semi-finished goods.