Global Printed Circuit Board Market Overview

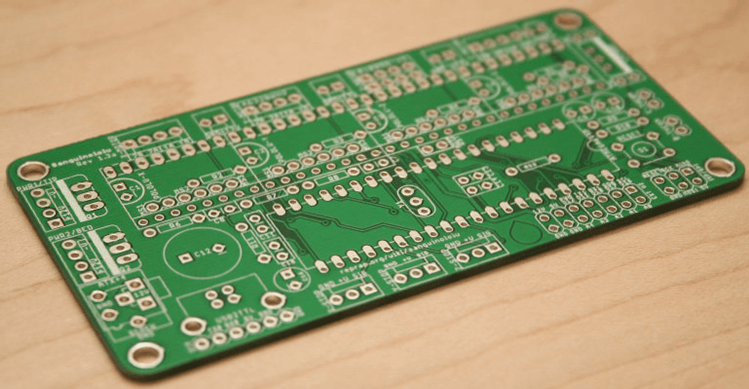

Printed circuit boards (PCBs) are crucial components that facilitate the functioning of electronic devices by connecting electronic components and circuits. They are widely used in communication electronics, consumer electronics, computers, automotive electronics, medical devices, aerospace, and industrial control systems. As a key indicator of a country or region’s technological advancement in the electronic information sector, the PCB industry plays a vital role in the overall electronic supply chain.

In the rapidly evolving landscape of cloud technology, 5G networks, big data, artificial intelligence, Industry 4.0, and the Internet of Things, the PCB industry is positioned to drive innovation and progress in the electronic industry. Despite a temporary slowdown in sectors like personal computers and smartphones, the global PCB market has shown resilience and is expected to grow steadily in the coming years.

Current Global PCB Industry Trends

- The global PCB output value is estimated to reach 63.5 billion U.S. dollars in 2018, marking an 8% increase from the previous year.

- Key drivers of PCB demand include 5G communications, Internet of Things, automotive electronics, Industry 4.0, cloud servers, and storage devices.

- The PCB industry is expected to sustain moderate growth over the next five years.

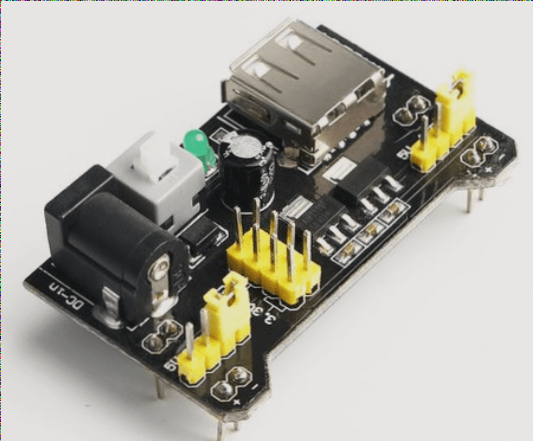

Development of China’s PCB Industry

China has emerged as a dominant player in the global PCB market, overtaking Japan to become the largest producer. With a significant share of the world’s PCB output value, China is at the forefront of the industry’s growth.

- In 2018, China’s electronic information manufacturing industry revenue reached 14.1 trillion yuan, with an 8% year-on-year growth rate.

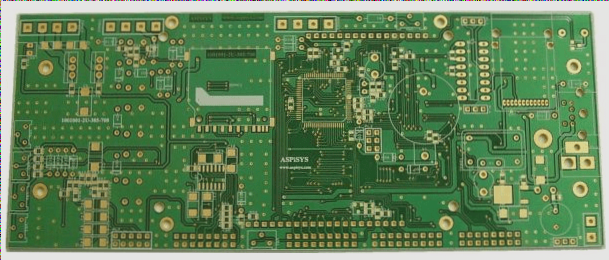

- Asia, particularly China and Southeast Asia, now accounts for nearly 90% of the world’s PCB output value.

- China’s share of the global PCB market output value increased from 31% in 2008 to 52% in 2018.

- Asia, led by China, is projected to maintain its dominance in the global PCB market, with an anticipated total output value of 35.7 billion U.S. dollars by 2022.