1. Electronic products invariably rely on PCBs. PCB (printed circuit board) is integral to nearly all electronic devices and is often referred to as the “mother of electronic system products.” Consequently, the PCB market trend closely mirrors the electronics industry’s trajectory.

2. With the rise of advanced and miniaturized electronics like mobile phones, notebook computers, and PDAs, the demand for flexible PCBs (FPCs) is increasing. PCB manufacturers are thus accelerating the development of thinner, lighter, and denser FPCs.

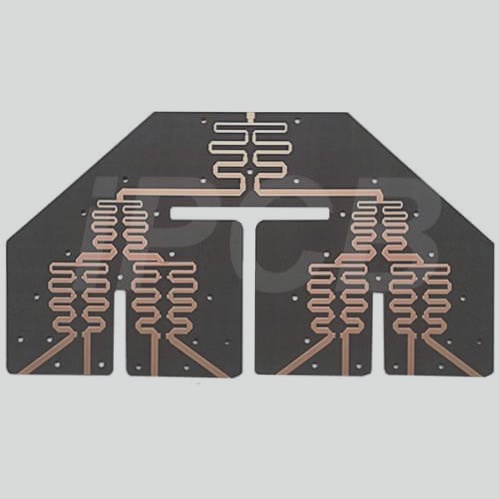

3. FPC (flexible circuit board) is a type of PCB, also known as a “soft board.”

4. FPCs are constructed from flexible substrates such as polyimide or polyester film. They offer benefits including high wiring density, light weight, thin profile, and significant flexibility. Capable of enduring millions of dynamic bends without damaging the wires, FPCs can adapt to spatial layout requirements, enabling three-dimensional assembly and the integration of component assembly with wire connections. This provides advantages unmatched by other types of circuit boards.

### FPC Product Technical Characteristics

1. FPC can be divided into PI, PET, and PEN based on the type of substrate film. Among these, PI cover film FPC is the most common type of flexible board, which can be further subdivided into single-sided PI cover film FPC, double-sided PI cover film FPC, multilayer PI cover film FPC, and rigid-flex PI cover film FPC.

2. **PI Cover Film FPC Classification**

3. The proliferation of smart terminals has led to an explosion in the FPC industry. Circuit boards are generally categorized into two types: rigid circuit boards and flexible circuit boards. Rigid circuit boards are primarily used in household appliances like refrigerators, whereas FPC soft boards were initially employed as connectors and electronic circuits in the market. Their use was relatively limited until Apple’s widespread adoption helped popularize them in consumer electronics. Apple strongly supports the FPC solution, incorporating as many as 14-16 FPCs in the iPhone, with 70% being multilayered and complex, and the total FPC area of the device being around 120 cm². Similarly, the FPC count in products like the iPad and Apple Watch also exceeds 10 units.

4. Following Apple’s lead, other mobile phone manufacturers such as Samsung, Huawei, and HOV quickly adopted FPC technology, increasing its use in their devices. Samsung phones, for instance, typically feature about 12-13 FPCs, primarily supplied by Korean manufacturers such as Interflex and SEMCO.

5. In the high-end FPC sector, flexible circuit boards have become essential components for consumer electronics like smartphones, medical devices, and wearables due to their lightweight, thin profile, and excellent flexibility. Production capacity is shifting, with the ratio of domestic FPC output value to global output value rising steadily from 6.74% in 2005 to 50.97% in 2016. The growth has accelerated since 2017, and it is anticipated that the domestic share will remain close to 70% in the future.

6. **Domestic FPC Companies Accelerate Technological Advancement**

7. The market’s technical demands for FPCs are increasing, with requirements for more layers, narrower line widths and spacings, smaller hole sizes, and enhanced flexibility. The key metric for assessing the technical sophistication of FPC products is line width and spacing, with current limits reaching 25 microns while still ensuring circuit yield.

8. High-end FPC products such as multilayer FPCs, blind and buried via FPCs, and second-order blind vias are also beginning to enter the market.

9. Given the development trends in wireless mobile communications, including innovations like OLED displays, 3D cameras, biometrics, and wireless charging, along with the advent of the 5G era, the penetration of FPCs in smart devices, flexible wearables, and automotive electronics is expected to increase significantly. This growth will create new opportunities for FPCs.

10. In China, it is crucial for local high-quality manufacturers with core FPC technologies to actively expand production to meet emerging growth drivers, thereby accelerating their advancement in the industry.

2. With the rise of advanced and miniaturized electronics like mobile phones, notebook computers, and PDAs, the demand for flexible PCBs (FPCs) is increasing. PCB manufacturers are thus accelerating the development of thinner, lighter, and denser FPCs.

3. FPC (flexible circuit board) is a type of PCB, also known as a “soft board.”

4. FPCs are constructed from flexible substrates such as polyimide or polyester film. They offer benefits including high wiring density, light weight, thin profile, and significant flexibility. Capable of enduring millions of dynamic bends without damaging the wires, FPCs can adapt to spatial layout requirements, enabling three-dimensional assembly and the integration of component assembly with wire connections. This provides advantages unmatched by other types of circuit boards.

### FPC Product Technical Characteristics

1. FPC can be divided into PI, PET, and PEN based on the type of substrate film. Among these, PI cover film FPC is the most common type of flexible board, which can be further subdivided into single-sided PI cover film FPC, double-sided PI cover film FPC, multilayer PI cover film FPC, and rigid-flex PI cover film FPC.

2. **PI Cover Film FPC Classification**

3. The proliferation of smart terminals has led to an explosion in the FPC industry. Circuit boards are generally categorized into two types: rigid circuit boards and flexible circuit boards. Rigid circuit boards are primarily used in household appliances like refrigerators, whereas FPC soft boards were initially employed as connectors and electronic circuits in the market. Their use was relatively limited until Apple’s widespread adoption helped popularize them in consumer electronics. Apple strongly supports the FPC solution, incorporating as many as 14-16 FPCs in the iPhone, with 70% being multilayered and complex, and the total FPC area of the device being around 120 cm². Similarly, the FPC count in products like the iPad and Apple Watch also exceeds 10 units.

4. Following Apple’s lead, other mobile phone manufacturers such as Samsung, Huawei, and HOV quickly adopted FPC technology, increasing its use in their devices. Samsung phones, for instance, typically feature about 12-13 FPCs, primarily supplied by Korean manufacturers such as Interflex and SEMCO.

5. In the high-end FPC sector, flexible circuit boards have become essential components for consumer electronics like smartphones, medical devices, and wearables due to their lightweight, thin profile, and excellent flexibility. Production capacity is shifting, with the ratio of domestic FPC output value to global output value rising steadily from 6.74% in 2005 to 50.97% in 2016. The growth has accelerated since 2017, and it is anticipated that the domestic share will remain close to 70% in the future.

6. **Domestic FPC Companies Accelerate Technological Advancement**

7. The market’s technical demands for FPCs are increasing, with requirements for more layers, narrower line widths and spacings, smaller hole sizes, and enhanced flexibility. The key metric for assessing the technical sophistication of FPC products is line width and spacing, with current limits reaching 25 microns while still ensuring circuit yield.

8. High-end FPC products such as multilayer FPCs, blind and buried via FPCs, and second-order blind vias are also beginning to enter the market.

9. Given the development trends in wireless mobile communications, including innovations like OLED displays, 3D cameras, biometrics, and wireless charging, along with the advent of the 5G era, the penetration of FPCs in smart devices, flexible wearables, and automotive electronics is expected to increase significantly. This growth will create new opportunities for FPCs.

10. In China, it is crucial for local high-quality manufacturers with core FPC technologies to actively expand production to meet emerging growth drivers, thereby accelerating their advancement in the industry.