Impact of 5G Technology on PCB Development

The advancement to 5G technology has brought about significant changes in the requirements for communication systems, especially in the realm of Printed Circuit Boards (PCBs). These changes are primarily a response to the increased speed, frequency, and data handling capabilities demanded by 5G networks.

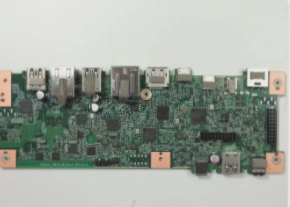

1. Increased PCB Complexity for Base Stations

- 5G networks necessitate more sophisticated communication boards for base stations due to wider frequency bands and higher frequencies.

- The integration of Massive MIMO technology into the Active Antenna Unit (AAU) requires larger PCB space, resulting in increased physical area and layer count.

- Specialized high-speed and high-frequency materials are essential for PCB substrates to ensure stable performance at elevated frequencies.

- Baseband Units (BBUs) in 5G stations handle significantly higher data transmission requirements, leading to larger and more complex PCB designs.

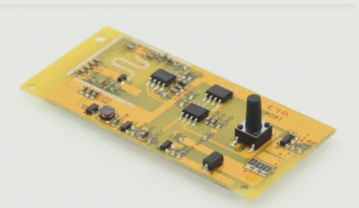

2. Thinner and Lighter Devices Drive FPC Growth

- The demand for thinner and lighter consumer electronics, such as smartphones and tablets, in the 5G era is fueling the growth of Flexible Printed Circuits (FPCs).

- 5G smartphone shipments are projected to constitute a growing share of the global market, driving the expansion of the FPC market.

Conclusion

5G technology is reshaping the PCB landscape by pushing for advanced materials and design techniques in base stations and consumer devices. The demand for high-performance substrates in complex base stations and the need for lightweight FPCs in mobile devices underscore the crucial role of PCB technology in the 5G era.

The global Flexible Printed Circuit (FPC) market is expanding rapidly, driven by the demand for advanced electronics, particularly in leading mobile phone manufacturers like Apple. The trend towards thinner tablets will further boost the adoption of FPC products. Domestic brands like Huawei, OPPO, and vivo are also increasing their FPC usage significantly.

In 2016, the global FPC market was valued at 85.2 billion yuan, with China’s market reaching 31.6 billion yuan. By 2021, China’s FPC market is projected to grow to 51.6 billion yuan, driven by the increasing demand for flexible circuits in consumer electronics and communications equipment.

The Future of PCB Industry in the Age of 5G

- The transition from 4G to 5G is set to boost FPC demand significantly.

- China’s major telecom operators have been rapidly expanding their base stations, with the number exceeding 3.14 million in 2016.

- 5G technology is expected to lead to a tenfold increase in small base stations.

- PCBs find applications in various industries such as computers, communication equipment, automotive electronics, and more.

- Communications, computers, and consumer electronics are the primary segments driving PCB industry growth.

- The global PCB market has been growing at an average rate of 4% annually, reaching $58.8 billion in 2017.

- China’s PCB output reached $29.7 billion in 2017, accounting for over 50% of global PCB production.

- The advent of 5G technology is expected to create new growth opportunities for high-frequency, high-performance PCB manufacturers.

- PCBs play a crucial role in the development of electronic devices, ensuring continuous and stable downstream demand.

- The evolution of the PCB industry mirrors the advancements in technology and the rapid growth of the global electronic information sector.

The future of the PCB market looks promising, especially with the proliferation of 5G and advanced electronics, signaling a transformative era in communication technologies.