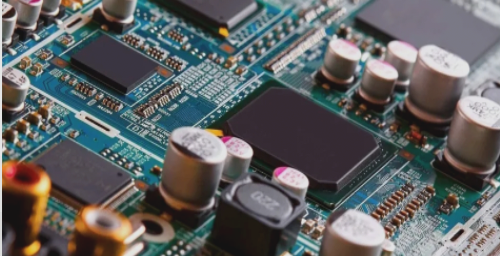

Currently, there are over two thousand PCB manufacturers worldwide, resulting in a fragmented industry with numerous small factories. However, the trend toward “large-scale and centralized” PCB manufacturers has become more pronounced. In recent years, leading PCB manufacturers globally have undergone a significant expansion in revenue. The market share of the largest PCB manufacturer rose from 11% in 2006 to 24% in 2018. This shift towards “large-scale and centralized” operations is driven by the substantial capital requirements, high technical standards, and intense competition within the industry. Additionally, it is influenced by the rapid upgrading of downstream terminal products and increasing market concentration. Consequently, large-scale PCB manufacturers with strong product design and R&D capabilities, as well as robust high-volume supply chains, can effectively meet the demands of large-scale customers regarding technology development and quality control.

1. Large-scale timely supply is crucial. However, small and medium-sized enterprises (SMEs) have revealed their weaknesses in this competitive landscape, creating a growing divide between them and larger PCB manufacturers. These larger manufacturers continue to build competitive advantages, expand operations, establish higher industry barriers, and enhance profitability. Consequently, they are increasingly dominating the market, resulting in an industry that is becoming more “large-scale and centralized.”

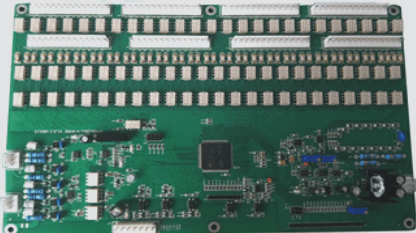

2. The advancement of downstream applications propels the PCB industry forward. The manufacturing quality of PCBs not only impacts the reliability of electronic products but also influences the overall competitiveness of downstream offerings. In terms of applications, communications electronics, consumer electronics, and computers have emerged as the three primary sectors for PCBs. The rise of personal computers in the 21st century has driven growth in the PCB sector for computers. Since 2008, smartphones have become the main catalyst for the development of the printed circuit board industry, with market share increasing from 22.18% to 31.3% by 2018, marking it as a rapidly growing area for PCB applications. Moving forward, emerging demands in sectors such as automotive electronics, wearable devices, industrial control, and medical equipment will introduce new growth opportunities for the PCB industry.

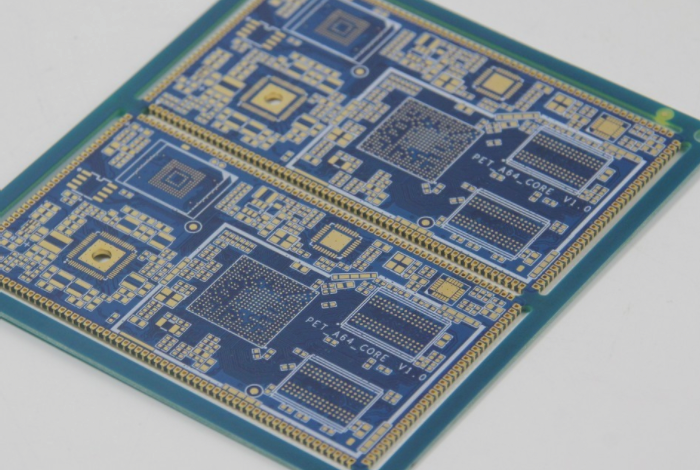

3. SLP will emerge as a competitive arena for large PCB manufacturers. Technological advancements have fueled the evolution of 3C electronic devices like smartphones towards greater lightness, thinness, miniaturization, and mobility. To achieve objectives of reduced space, increased speed, and enhanced security, the demand for “small” continues to escalate. As the functionalities of smart electronic devices, particularly mobile phones, expand, the number of I/Os increases, necessitating further reduction in line width and spacing. However, traditional HDI manufacturing processes are constrained and unable to meet these demands, particularly with higher stacked layers. This is where SLP technology, which offers smaller line width and spacing while accommodating more functional modules, becomes essential. SLP (substrate-like PCB) represents an advanced form of HDI, primarily utilizing semi-additive technology—a production method that sits between subtractive and fully additive processes. This method is more sophisticated than full additive techniques, achieving a degree of graphic refinement and reliability suitable for high-end products and enabling mass production. The semi-additive process is adept at creating fine line spacings between 10/10 and 50/50 μm. As an optimized solution meeting both mobile phone space and signal transmission requirements, the gradual mass production and adoption of SLP are set to transform the industry landscape. Companies with first-mover advantages are likely to capitalize on this opportunity to further enhance their competitive edge. The SLP market is projected to experience explosive growth in the next three years, with numerous smartphone manufacturers planning to integrate SLP into their products starting in 2017.