Tesla’s Advancements in Automotive Electronics

Last October, Tesla made a groundbreaking announcement regarding the integration of full self-driving capabilities into all their vehicles. This upgrade includes a sophisticated setup of 8 cameras, 12 ultrasonic sensors, an advanced radar system, and NVIDIA’s powerful Drive PX2 onboard computer.

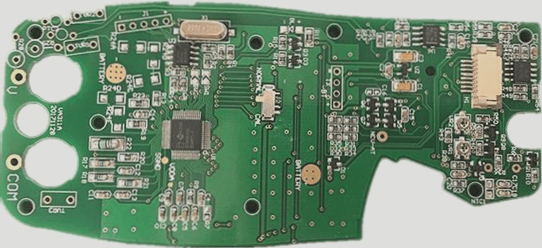

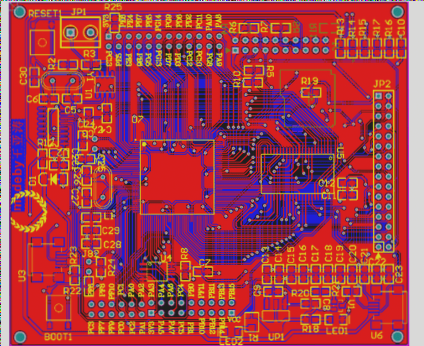

Evolution of Automotive PCB Technology

The realm of automotive electronics has witnessed a remarkable transformation with the rise of electric vehicles and autonomous driving. Statistics from Prismark reveal that the production value of automotive PCB products surged from 3.7% in 2009 to 8.8% in 2017, with an estimated value of $5.2 billion.

Future Trends in Automotive Electronics

- Smart cars and new energy vehicles are set to dominate the automotive electronics landscape, with an emphasis on driverless technology and advanced ADAS safety systems.

- ADAS sensors rely heavily on high-frequency PCBs to support millimeter radar waves at 24GHz and 77GHz.

- New energy vehicles feature crucial components like vehicle controllers, motor controllers, and battery management systems (BMS), driving the demand for PCBs.

- Each new energy vehicle requires 2.5 square meters of PCB area, constituting 10% of the BMS cost and fueling substantial growth in the PCB market.

- The automotive PCB sector is projected to be the fastest-growing segment in the next five years, attracting significant investments from Japanese and Taiwanese manufacturers.

Challenges and Opportunities in the PCB Industry

- Despite the overall prosperity of the PCB industry, China’s sector is still emerging, with companies varying in R&D capabilities and growth trajectories.

- While some companies remain stagnant as “processing factories,” others are actively investing in R&D and optimizing their strategies for sustainable growth.

- As the industry matures, a natural selection process will occur, distinguishing successful firms from those that struggle to adapt.

- Industry consolidation is inevitable, with larger players expected to dominate the market landscape.

Embracing innovation and adapting to the evolving landscape of automotive electronics and PCB technology are essential for companies to thrive in this dynamic industry.