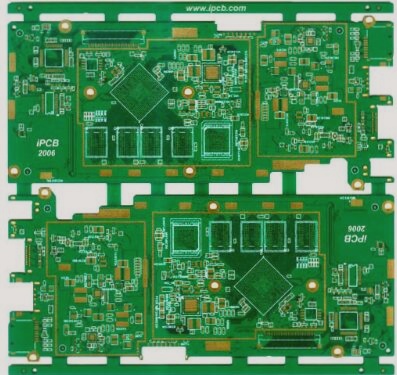

PCB Industry Overview

The PCB industry chain consists of three main segments: upstream, midstream, and downstream. The upstream segment includes raw materials like copper clad laminates, foils, and prepregs. For flexible circuit boards, cover films and electromagnetic films are essential. Midstream involves PCB manufacturers, while downstream applications cover a wide range, with computer, communication electronics, and consumer electronics leading the market.

Market Trends

- The demand for lightweight mobile devices is boosting the Flexible Printed Circuit (FPC) market.

- 5G technology is driving the need for high-value-added PCBs, with China investing significantly in infrastructure.

- The server market is expanding rapidly, requiring advanced PCB designs to meet evolving technology needs.

- The automotive PCB market is growing, fueled by the rise of new energy vehicles and increasing automotive electronics sophistication.

Key Developments

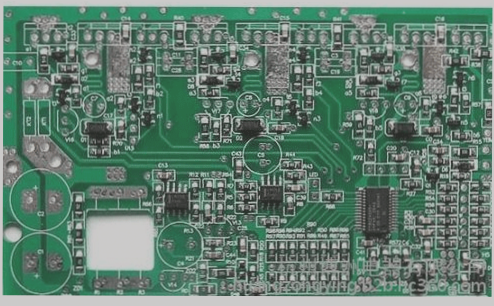

In the era of intelligent and slim electronic products, FPC offers advantages like high density, light weight, and bending resistance. The rise of 5G technology is increasing demand for specialized PCBs, while the automotive industry’s shift towards new energy vehicles is propelling PCB market growth.

Driving Forces in the PCB Industry

The PCB industry is experiencing a shift driven by environmental protection oversight and automation. The enforcement of stricter environmental regulations since 2017 has forced many manufacturers to upgrade their production capabilities to meet compliance standards. This has led to a consolidation trend in the industry, with leading companies benefiting from enhanced environmental credentials and automated production processes.

Environmental Regulations Impacting Production

- Stricter regulations have prompted production restrictions and rectifications for PCB manufacturers.

- Companies with strong environmental protection credentials are expanding their production capacity.

Automation Enhancing Efficiency

The adoption of automation technologies is driving operational efficiency in PCB manufacturing. Automated processes improve yield, gross profit margins, and supply chain cost control for leading manufacturers, putting pressure on smaller factories to keep up.

Overall, the industry is witnessing a shift towards larger, centralized operations as smaller factories struggle to upgrade due to financial constraints. This trend is reshaping the PCB landscape and paving the way for a more streamlined and efficient production ecosystem.