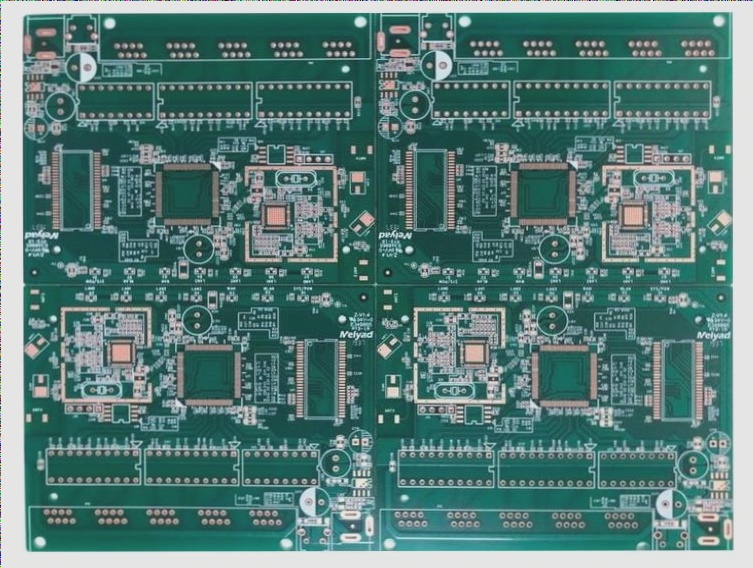

In recent years, the sales volume of new energy vehicles in China has seen a significant increase, driven by the new energy vehicle policy. In 2018, the sales volume of new energy vehicles reached 1.256 million, marking a 67.1 percent increase year-on-year. The first quarter of 2019 also saw a 109.7 percent year-on-year increase in sales of new energy vehicles, reaching 299,000. This impressive growth in the automotive industry is leading to a surge in the demand for automotive PCB (printed circuit board) in terms of both volume and price. The trend of automobile electrification and electronization in recent years has made PCBs an integral part of automotive electronic systems.

The consumption of PCB in new energy vehicles is nearly four times that of traditional fuel vehicles, with the price of PCB for a single vehicle exceeding 1,200 yuan. Components such as on-board chargers, DC-DC converters, inverters, and battery management systems in new energy vehicles require a large number of PCBs. China boasts one of the highest penetration rates and total volumes of new energy vehicles globally, and this high growth rate is expected to continue in the coming years, benefiting relevant PCB suppliers.

Many A-share listed PCB manufacturers have identified automotive business as their main focus, contributing significantly to incremental revenue in recent years. In 2018, the top six automotive businesses among A-share listed companies accounted for about 12% of the global automotive PCB market share, up from 10% in 2017. Since the start of the new century, the PCB industry has shifted eastward, with China’s domestic output share increasing from 17% to more than 50%. China is a key producer of downstream PCBs, and the global share of automotive PCB manufacturers is expected to continue to rise.

Shanghai Electric Power Co., Ltd., a leading domestic company in automotive PCB, has actively engaged in international cooperation, introducing advanced technology and achieving mass production of high-frequency PCB for millimeter-wave radar. Additionally, a number of PCB manufacturers have expanded their coverage to include downstream power batteries, charging systems, and other electronic systems for new energy vehicles. The domestic automotive PCB business is poised to play an increasingly important role in the incremental revenue of PCB manufacturers, and with the rapid development of domestic downstream markets, domestic PCB enterprises are expected to capture a share from multinational enterprises.

The consumption of PCB in new energy vehicles is nearly four times that of traditional fuel vehicles, with the price of PCB for a single vehicle exceeding 1,200 yuan. Components such as on-board chargers, DC-DC converters, inverters, and battery management systems in new energy vehicles require a large number of PCBs. China boasts one of the highest penetration rates and total volumes of new energy vehicles globally, and this high growth rate is expected to continue in the coming years, benefiting relevant PCB suppliers.

Many A-share listed PCB manufacturers have identified automotive business as their main focus, contributing significantly to incremental revenue in recent years. In 2018, the top six automotive businesses among A-share listed companies accounted for about 12% of the global automotive PCB market share, up from 10% in 2017. Since the start of the new century, the PCB industry has shifted eastward, with China’s domestic output share increasing from 17% to more than 50%. China is a key producer of downstream PCBs, and the global share of automotive PCB manufacturers is expected to continue to rise.

Shanghai Electric Power Co., Ltd., a leading domestic company in automotive PCB, has actively engaged in international cooperation, introducing advanced technology and achieving mass production of high-frequency PCB for millimeter-wave radar. Additionally, a number of PCB manufacturers have expanded their coverage to include downstream power batteries, charging systems, and other electronic systems for new energy vehicles. The domestic automotive PCB business is poised to play an increasingly important role in the incremental revenue of PCB manufacturers, and with the rapid development of domestic downstream markets, domestic PCB enterprises are expected to capture a share from multinational enterprises.