The Rise of Flexible Printed Circuits (FPC) in Modern Electronics

In recent years, the consumer electronics market has witnessed significant growth, driven by the popularity of mobile devices like smartphones and tablets. This surge has led to a demand for smaller and thinner designs, pushing traditional Printed Circuit Boards (PCBs) to their limits. To meet the evolving needs of electronic products, manufacturers have turned to innovative technologies, with Flexible Printed Circuits (FPC) emerging as a leading alternative.

The Impact of Emerging Markets on FPC Demand

The rise of wearable smart devices and drones has further boosted the demand for FPC products. These technologies not only open up new opportunities but also allow for innovative designs that were previously unattainable with traditional PCBs. The integration of display and touch-control features in electronic products has also expanded the application of FPCs, especially with the increasing use of small to medium-sized LCD screens and touch interfaces.

The Future of Flexible Electronics

Forecasts indicate that flexible electronics will drive a multi-trillion-dollar market in the years to come. This presents a significant opportunity for countries like China to advance their electronics industry and establish themselves as global leaders in this rapidly evolving field. Flexible electronics could become a cornerstone of national industry, fostering economic growth and technological innovation.

- High wiring density

- Lightweight and thin

- Flexible and durable

- Three-dimensional assembly capabilities

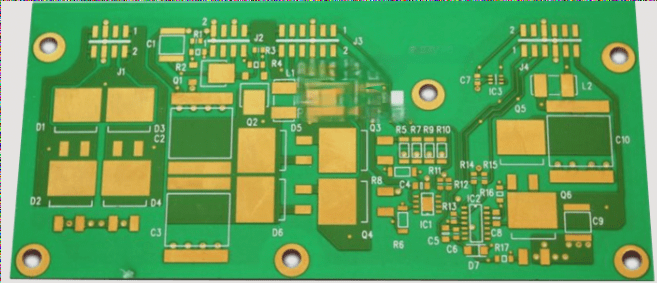

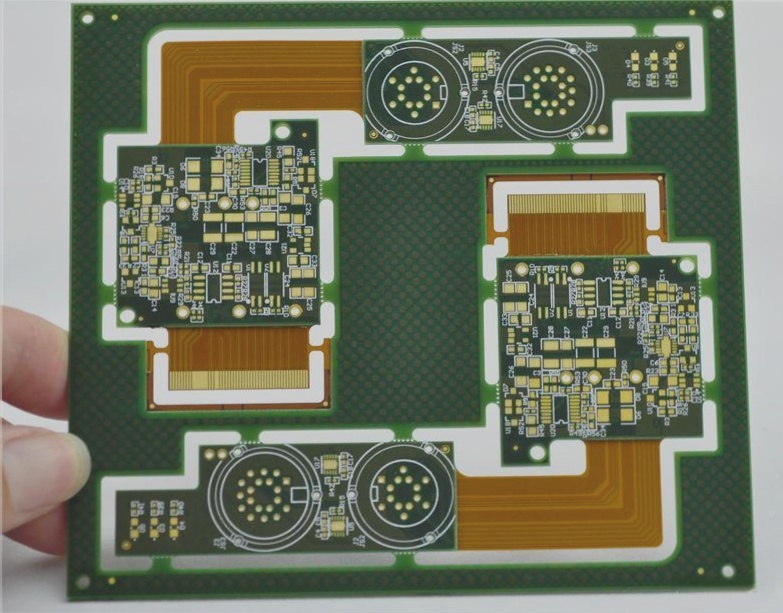

Classification of FPCs

FPCs are categorized based on the substrate film used, such as Polyimide (PI), Polyester (PET), and Polyethylene Naphthalate (PEN). PI-based FPCs are the most common and come in various types, including single-sided, double-sided, multi-layer, and rigid-flex FPCs. While rigid circuit boards find their place in household appliances, flexible circuit boards like FPCs have become essential in consumer electronics due to their unique properties.

The Influence of Apple on FPC Adoption

Apple’s widespread use of FPC technology, with iPhones incorporating multiple FPCs, has played a crucial role in popularizing FPCs. Other smartphone manufacturers like Samsung, Huawei, and HOV have followed suit, integrating FPCs into their devices. Samsung, for instance, relies on Korean FPC manufacturers like Interflex and SEMCO for their FPC needs.

The Rise of Wireless Charging in the Smartphone Industry

In the realm of smartphones, the trend towards wireless charging is rapidly gaining traction, offering a convenient alternative to traditional charging cables. Flexible Printed Circuit (FPC) solutions have emerged as a favored option for wireless charging technology, with industry giants like Samsung leading the way. Samsung has embraced an integrated approach by combining FPC with Near Field Communication (NFC) and Magnetic Secure Transmission (MST) technologies. The upcoming iPhone 8 is anticipated to feature wireless charging, potentially leveraging Samsung’s comprehensive FPC+NFC+MST solution. This development is expected to inspire local manufacturers such as HOV to follow suit, further propelling the advancement of wireless charging technology. By 2019, the demand for FPCs in wireless charging modules for Apple, Samsung, and HOV could result in an additional FPC production value of nearly 4 billion yuan.

Asia’s Dominance in Global PCB Manufacturing

Since the early 2000s, the landscape of global Printed Circuit Board (PCB) manufacturing has shifted towards Asia, driven by factors like cost-effective labor, efficient transportation, and dynamic industry supply chains. China, in particular, has experienced a significant expansion in PCB production capacity, establishing itself as the world’s largest PCB production center by 2006.

China’s Ascendancy in the FPC Sector

This manufacturing trend is also evident in the high-end Flexible Printed Circuit (FPC) sector, where China’s production capacity continues to grow. In 2005, China represented 6.74% of the global FPC output value, a figure that surged to 47.97% by 2015. Projections indicate that this percentage will hover around 50% in the foreseeable future, highlighting China’s increasing dominance in the global FPC market.

The Evolution of FPC Technology

Flexible Printed Circuit (FPC) technology has undergone significant advancements, fueled by its distinctive benefits in flexibility, high-density design, and space efficiency. With ongoing innovations and expanding adoption, particularly in smartphones and wireless charging applications, FPC is positioned to play a pivotal role in shaping the future of consumer electronics.