Ensuring Quality of Solder Joints in PCB Assembly

Introduction

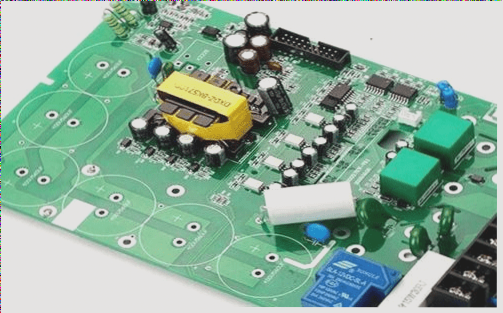

Ensuring the quality of solder joints is crucial for high-precision PCB assembly, especially with dense component placement. Solder joints serve as connection bridges for components, directly impacting the performance of electronic devices.

Identification of PCB Cold Soldering

- Use specialized online testing equipment for detection.

- Perform visual inspection or AOI (Automated Optical Inspection) to identify issues such as insufficient solder, poor solder penetration, cracks, or improper bonding.

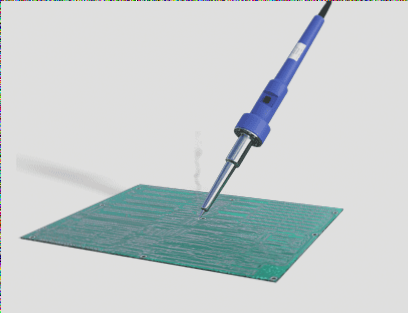

Causes and Solutions of PCB Virtual Soldering

- Defective pad design: Avoid through-holes in pads to prevent solder loss and ensure standardized spacing and area.

- Oxidation of the PCB: Remove oxide layer with an eraser, dry damp PCBs, and clean oil or sweat stains with absolute ethanol.

- Solder paste depletion: Reapply solder paste immediately if scraping reduces material on pads.

PCB Demand Growth and Future Focus Areas

The PCB market is rapidly growing, focusing on high-end HDI and packaging substrates. The server PCB market is expanding, with future revenue potential in 5G technologies. The automotive PCB market is also growing, with electrification and intelligence in automobiles driving demand.

Key Points:

- Global automotive PCB market projected to reach $10.171 billion by 2023.

- Output value for automotive electrification PCBs expected to rise with a CAAGR of 23.61%.

- Demand for safety-critical automotive PCBs creates significant profit potential for manufacturers.

Consumer Electronics PCB Market Trends

In recent years, the consumer electronics industry has seen significant innovation, creating new opportunities for consumer electronics PCBs. According to Prismark, the value of PCBs in consumer electronics reached $24.171 billion in 2018 and is projected to grow to $28.87 billion by 2022, with a Compound Annual Growth Rate (CAAGR) of 4.2%.

Smart Wearable Devices

The market for smart wearable devices has been booming, with shipments expected to increase from 135 million units in 2018 to around 205 million units by 2023, showing a remarkable CAAGR of 23%. This growth is fueling demand for flexible printed circuits (FPCs).

5G Technology Impact

The advent of 5G technology is set to drive growth in the smartphone sector. It is forecasted that 5G smartphone shipments will hit 725 million units by 2023, leading to increased demand for high-end PCBs like SLP and advanced HDI boards. Manufacturers specializing in FPCs, SLP, and high-end HDI boards are expected to benefit from these developments.

Opportunities for Domestic PCB Industry

While China’s PCB industry has historically focused on low-end products, there is a promising opportunity for domestic manufacturers to penetrate the high-end market. With the rise of China’s independent electronics brands and trade dynamics, the outlook for high-end PCB manufacturers in China is becoming more favorable.

Global High-End PCB Market

Although the high-end PCB market is currently dominated by foreign companies, the landscape is shifting due to trade tensions and the increasing demand from China. By enhancing financing options, investing in R&D, and expanding production capacity, leading Chinese PCB companies are well-positioned to capture a larger share of the global high-end PCB market.

If you are in need of PCB manufacturing services, feel free to contact us.