Latest Trends in the PCB Industry

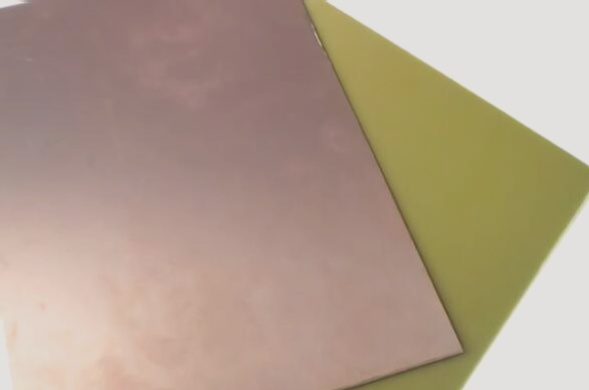

1. The reduction in raw material prices has caused an oversupply of components in the PCB industry. As the off-season comes to an end, copper foil manufacturers are expected to adjust their production capacity. This adjustment, along with an effective price transmission mechanism, will enable leading copper-clad laminate and PCB manufacturers to pass on raw material costs. This will help alleviate the pressure of rising costs and create more room for performance improvement.

Downstream Applications:

- The annual growth rate of PCB market demand in various sectors has exceeded double digits, driving the industry’s growth.

- The automotive PCB market is expected to surpass 100 billion yuan due to the acceleration of new energy and electrification in automobiles. The demand for PCBs in new energy vehicles is projected to increase by tens of billions.

- The small-pitch LED market’s prosperity is fueling demand for multi-layer PCBs.

- Advancements in mobile communication technology and the deployment of high-density small base stations are increasing the need for high value-added PCBs.

- The high-end server market in China is expanding rapidly, leading to a higher demand for high-standard PCB products. Additionally, the trend towards thinner and lighter consumer and automotive electronics is boosting the volume and price of FPCs.

2. PCB listed companies are focusing on adjusting their product structures to meet downstream market demands, enhancing overall profitability. However, compared to upstream industries, many domestic PCB companies have varying product quality and production capacity. With considerations for resource acquisition and environmental protection, outdated production capacity will be phased out, leading to increased industry concentration. High-quality PCB manufacturers in China are expected to leverage their advantages to accelerate the global shift in the industry and potentially emerge as global leaders, replacing major overseas factories.