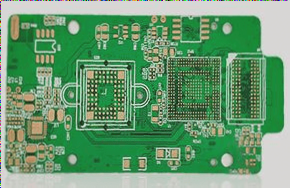

Printed Circuit Board (PCB) Industry Overview

Printed circuit boards (PCBs) are essential substrates used for assembling electronic parts. With a global output value of US$45 billion per year, the PCB industry ranks second only to the semiconductor industry in the electronics sector. China, with its rapid growth rate, is emerging as a dominant player in the PCB market worldwide.

Shift Towards China

Due to cost advantages and market opportunities, the PCB industry is gradually shifting towards China. The country offers a competitive edge in both production costs and market access, making it the fastest-growing PCB market globally.

Differentiation in PCB Market

Low-end PCBs (up to 4 layers) face intense competition and pricing pressures, while high-end PCBs such as High-Density Interconnect (HDI) boards require advanced technology and craftsmanship, leading to higher barriers to entry and limited supply in China.

Growth Potential for Chinese Manufacturers

Chinese PCB manufacturers are rapidly expanding their production capacity, focusing on high-end products. This strategic shift indicates significant growth potential for the Chinese PCB industry.

Challenges and Opportunities

While Copper Clad Laminate (CCL) and downstream machine products exhibit higher concentration and bargaining power, they heavily rely on PCBs. This dependency creates opportunities for small-scale manufacturers catering to specific market segments.

Industry Dynamics

Large CCL manufacturers are scaling up production, emphasizing industry consolidation for sustained growth. However, short-term challenges like price wars and raw material cost fluctuations impact profitability.

Environmental Regulations and Innovation

Increasing raw material prices and stringent environmental regulations in China are driving downstream industry integration, raising entry barriers, and encouraging technological innovation in the PCB sector to meet evolving market demands.

Trends in Electronic Yarn Industry

The development of PCBs has spurred growth in high-end electronic yarn production, with a shift towards tulle-like materials and in-house kiln facilities. The focus on technological innovation and meeting high-end customer requirements remains crucial for PCB manufacturers to thrive.