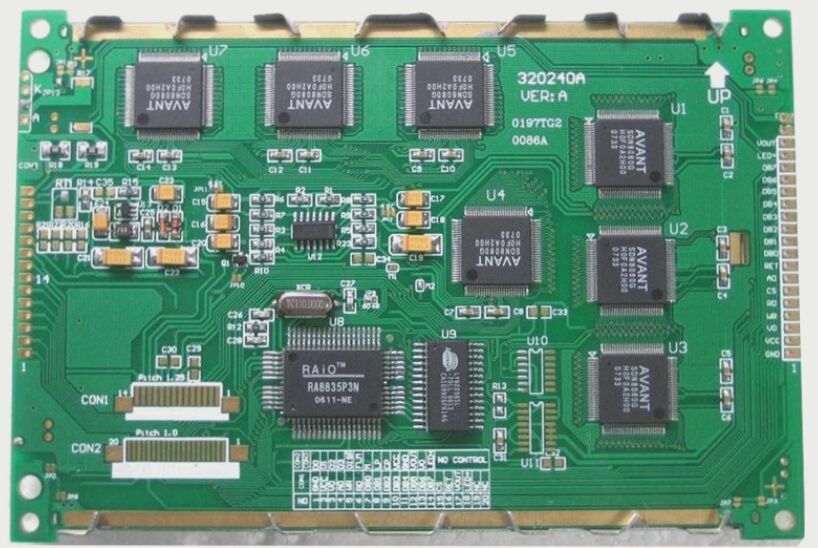

1. PCB (Printed Circuit Board) is one of the most dynamic sectors within the modern electronic components industry, typically growing at a rate approximately 3% higher than that of the broader electronic components market.

2. Based on an analysis of various factors, it is anticipated that this rapid growth will persist into 2006.

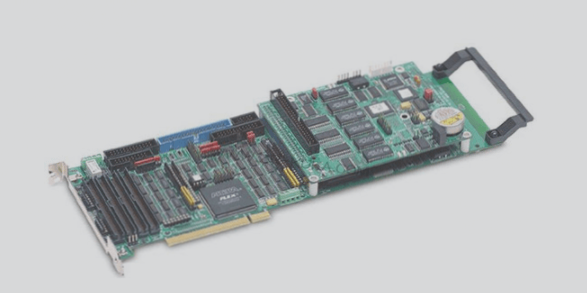

3. Demand upgrades and industrial transfers serve as the primary driving forces behind the industry’s development, while HDI boards, flexible boards, and IC packaging boards (BGA, CSP), among other varieties, will emerge as key growth areas.

4. The surge in electronic consumer devices is fueling the expansion of PCBs.

5. As fundamental components of a wide range of electronic products, the development of the PCB industry is significantly influenced by the demand for downstream terminal products and the overall health of the IT industry.

6. Following the burst of the IT industry bubble in 2001, the global IT sector began its recovery in 2003, leading to a complete resurgence in the PCB industry as well.

7. In 2003, the output value of printed circuit boards in China reached 50.1 billion yuan, marking a year-on-year increase of 32.40%.

8. This output value propelled China to the second-largest position globally, with projections suggesting it could reach 86.9 billion yuan by 2005.

In 2008, the output value of PCBs is anticipated to exceed Japan’s, positioning it as the world’s leader. Downstream factors driving this growth include consumer electronics like mobile phones, laptops, digital products, and liquid crystal displays, which have significantly boosted demand and technological advancements in the PCB sector. In 2004, global PCB output was valued at $40.172 billion, reflecting a 16.47% increase. This trend is expected to persist, with estimates for 2005 suggesting a global output value of $43.815 billion, corresponding to a growth rate of 9.07%. High-density multilayer and flexible PCBs are emerging as key highlights. To align with the trends toward multifunctionality, miniaturization, and lightweight electronic products, next-generation systems necessitate high-density, highly integrated, miniaturized, and multilayer PCBs. Varieties such as HDI boards, flexible boards, and IC packaging boards (BGA, CSP) are set to drive significant growth. China’s PCB output from 2003 to 2005 reached 50.1 billion yuan, 66.1 billion yuan, and 86.9 billion yuan, with annual increases of 33%, 32%, and 31%, respectively. Since 2000, China’s flexible board output has surged at an impressive rate of 61.77%, well above the global average for FPCs, and is expected to maintain a strong growth trajectory in 2006. The rapid expansion of multilayer, HDI, and flexible boards is optimizing China’s PCB industry structure, establishing it as the world’s largest industrial base. Regionally, the focus of the PCB industry is increasingly shifting to Asia.

In 1998, the PCB industry was largely dominated by the United States, Japan, and Europe, collectively accounting for about 73.40% of global output. However, this landscape has significantly changed post-2000. The gradual migration of downstream industries to Asia, combined with lower labor costs, has attracted numerous PCB manufacturers to the region. China has emerged as the leading area for development, benefiting from concentrated downstream industries and relatively low costs for labor and land. In 2003, China surpassed the United States for the first time, becoming the world’s second-largest PCB producer. Its share of output value nearly doubled, rising from 8.54% in 2000 to 15.30%. According to Prismark’s projections, China is set to replace Japan as the leading PCB production base by 2008. The Chinese PCB industry continues to expand rapidly; in 2003, the output value reached 50.069 billion yuan, a staggering 333% increase year-on-year, surpassing the United States for the first time. In both 2004 and 2005, China’s output value maintained growth rates exceeding 30%, reaching an estimated 86.9 billion yuan in 2005, significantly outpacing global growth rates. Imports and exports have also surged, although high-end products remain in short supply. After exceeding $6 billion in total PCB trade in 2003, China’s exports broke $8 billion in 2004, reaching $8.890 billion—an increase of 47.43% from 2003. The import-export deficit in 2004 was approximately $1.2 billion, with high-tech multilayer boards, HDI boards, and flexible boards comprising a substantial share. Amidst rising demand for electronic products, global PCB industry growth, and the migration of industries to Asia, foreign investment has been crucial to the maturity and advancement of the PCB sector in mainland China, which achieved an output value of $8.05 billion in 2004.

2. Based on an analysis of various factors, it is anticipated that this rapid growth will persist into 2006.

3. Demand upgrades and industrial transfers serve as the primary driving forces behind the industry’s development, while HDI boards, flexible boards, and IC packaging boards (BGA, CSP), among other varieties, will emerge as key growth areas.

4. The surge in electronic consumer devices is fueling the expansion of PCBs.

5. As fundamental components of a wide range of electronic products, the development of the PCB industry is significantly influenced by the demand for downstream terminal products and the overall health of the IT industry.

6. Following the burst of the IT industry bubble in 2001, the global IT sector began its recovery in 2003, leading to a complete resurgence in the PCB industry as well.

7. In 2003, the output value of printed circuit boards in China reached 50.1 billion yuan, marking a year-on-year increase of 32.40%.

8. This output value propelled China to the second-largest position globally, with projections suggesting it could reach 86.9 billion yuan by 2005.

In 2008, the output value of PCBs is anticipated to exceed Japan’s, positioning it as the world’s leader. Downstream factors driving this growth include consumer electronics like mobile phones, laptops, digital products, and liquid crystal displays, which have significantly boosted demand and technological advancements in the PCB sector. In 2004, global PCB output was valued at $40.172 billion, reflecting a 16.47% increase. This trend is expected to persist, with estimates for 2005 suggesting a global output value of $43.815 billion, corresponding to a growth rate of 9.07%. High-density multilayer and flexible PCBs are emerging as key highlights. To align with the trends toward multifunctionality, miniaturization, and lightweight electronic products, next-generation systems necessitate high-density, highly integrated, miniaturized, and multilayer PCBs. Varieties such as HDI boards, flexible boards, and IC packaging boards (BGA, CSP) are set to drive significant growth. China’s PCB output from 2003 to 2005 reached 50.1 billion yuan, 66.1 billion yuan, and 86.9 billion yuan, with annual increases of 33%, 32%, and 31%, respectively. Since 2000, China’s flexible board output has surged at an impressive rate of 61.77%, well above the global average for FPCs, and is expected to maintain a strong growth trajectory in 2006. The rapid expansion of multilayer, HDI, and flexible boards is optimizing China’s PCB industry structure, establishing it as the world’s largest industrial base. Regionally, the focus of the PCB industry is increasingly shifting to Asia.

In 1998, the PCB industry was largely dominated by the United States, Japan, and Europe, collectively accounting for about 73.40% of global output. However, this landscape has significantly changed post-2000. The gradual migration of downstream industries to Asia, combined with lower labor costs, has attracted numerous PCB manufacturers to the region. China has emerged as the leading area for development, benefiting from concentrated downstream industries and relatively low costs for labor and land. In 2003, China surpassed the United States for the first time, becoming the world’s second-largest PCB producer. Its share of output value nearly doubled, rising from 8.54% in 2000 to 15.30%. According to Prismark’s projections, China is set to replace Japan as the leading PCB production base by 2008. The Chinese PCB industry continues to expand rapidly; in 2003, the output value reached 50.069 billion yuan, a staggering 333% increase year-on-year, surpassing the United States for the first time. In both 2004 and 2005, China’s output value maintained growth rates exceeding 30%, reaching an estimated 86.9 billion yuan in 2005, significantly outpacing global growth rates. Imports and exports have also surged, although high-end products remain in short supply. After exceeding $6 billion in total PCB trade in 2003, China’s exports broke $8 billion in 2004, reaching $8.890 billion—an increase of 47.43% from 2003. The import-export deficit in 2004 was approximately $1.2 billion, with high-tech multilayer boards, HDI boards, and flexible boards comprising a substantial share. Amidst rising demand for electronic products, global PCB industry growth, and the migration of industries to Asia, foreign investment has been crucial to the maturity and advancement of the PCB sector in mainland China, which achieved an output value of $8.05 billion in 2004.