Automotive PCBs: Driving Innovation in the Automotive Industry

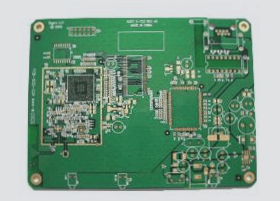

The automotive sector is experiencing a significant transformation, evolving from traditional mechanical systems to sophisticated mechatronic solutions that combine mechanics and electronics. This shift is fueled by the rapid growth of automotive electronics, which play a crucial role in enhancing vehicle performance and safety.

Reliability Challenges and Market Dynamics

- Automotive PCBs face stringent reliability standards due to the demanding operating conditions of vehicles.

- Manufacturers in the automotive industry must navigate a recall system, increasing the pressure to deliver high-quality products.

- Entry barriers for vehicle PCBs are high, requiring rigorous verification tests and lengthy certification processes.

Categories of Automotive Electronics

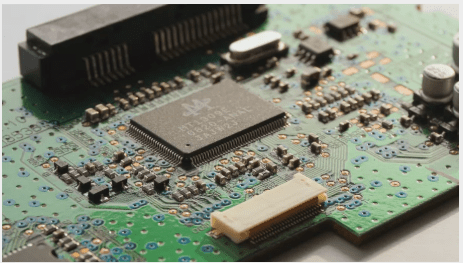

- Body Electronic Control Systems: Integrate mechanical systems with electronic components to enhance performance and ensure safety.

- Vehicle Electronic Control Systems: Encompass multimedia, navigation, and safety systems to enhance convenience and driving experience.

The Rise of Advanced Driver Assistance Systems (ADAS)

- ADAS technology is driving growth in the automotive industry, with a focus on safety and convenience.

- Market penetration of ADAS is projected to grow significantly, reaching a market size of around $30 billion by 2020.

- ADAS relies on PCBs to implement operational, safety, and control functions, with a growing demand for high-frequency automotive PCBs.

Millimeter-Wave Radar in ADAS

- Millimeter-wave radar is a core sensor in ADAS systems, operating at frequencies of 24GHz and 77GHz.

- 77GHz radar measures vehicle speed and distance, while 24GHz radar monitors objects near the vehicle.

- The use of millimeter-wave radar is increasing, driving demand for high-frequency automotive PCBs.

As the automotive industry continues to embrace electronics and advanced technologies, the demand for high-quality PCBs will play a crucial role in shaping the future of automotive innovation.