The Current State of the PCB Industry: Trends and Challenges

Recent developments have brought about a shift in the outlook of the Printed Circuit Board (PCB) industry, moving from optimism to a more cautious stance. The primary driver behind this change is the prevailing global uncertainty, particularly concerning ongoing trade wars and their potential impact on the global economy.

Impact of Global Uncertainties and Mobile Market Challenges

While tariffs themselves may not be a significant concern for the PCB sector, the broader economic repercussions of trade disputes are causing industry players to adopt a more conservative approach. The mobile phone market, a key driver of PCB demand, is also facing challenges, with sluggish sales of new Apple devices in 2018 leading to a decline in revenue and demand for PCB products.

Adopting a Conservative Growth Strategy

The industry’s response to these challenges includes a shift towards optimizing existing production capacities rather than aggressive expansion. Major PCB manufacturers are refraining from significant capacity expansions in the upcoming year, focusing instead on increasing production layers without a substantial rise in overall output.

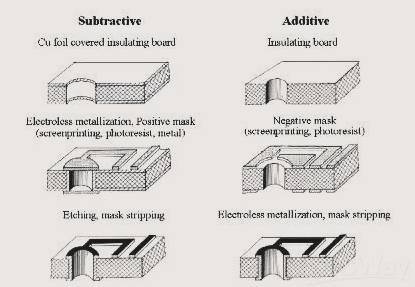

Technological Advancements and Management Practices

Efforts to catch up with domestic investments in the PCB industry have seen significant progress in 5G-related technologies by leading players like Shennan Circuits and Hushi Electronics. Additionally, effective corporate management remains crucial for the long-term sustainability of PCB factories, emphasizing the importance of optimizing production efficiency and improving yield rates.

China’s Growing Dominance and Industry Consolidation

As the global PCB manufacturing landscape consolidates in China, the country’s share of global PCB production value is expected to surpass 60% within five years. With steady demand and technological advancements driving growth, the industry is witnessing increased market competitiveness among larger companies, leading to further consolidation as smaller enterprises face pressure to adapt.

Steady Growth and Global Competitiveness

China’s PCB industry is experiencing sustained growth, with export values on the rise. In the first quarter of 2019, China’s PCB exports totaled $5.95 billion, highlighting the sector’s global competitiveness and expansion.